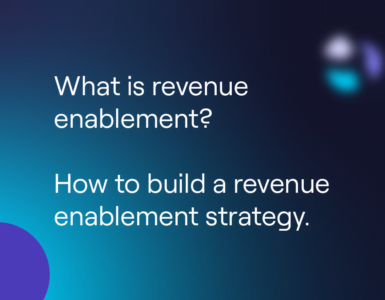

A busy high street scene with a couple holding hands and walking past fashion shopsGETTY

A UK parliamentary inquiry into the decline of high streets and town centers has issued a proposal for an online sales tax to help secure their future. “The High Streets and Town Centres in 2030 inquiry, led by Labour MP Clive Betts, was launched in May 2018. Its first report, published on February 21, 2019, proposes that an online sales tax, sealed into law could help provide “meaningful relief” for physical retailers, who have to grapple with higher costs due to business rates for commercial properties.

In addition to the online sales tax, the Housing, Communities and Local Government Committee also recommended a replacement of business rates (an English tax on the occupation of non-domestic property) with a sales tax or an increase in VAT. The final tax-related proposal was an introduction of “green taxes” on online deliveries and packaging. Put together, the reduction in business rates and the green taxes would help “level the playing field” for physical retailers, the report argues.

The EU Snag

The idea of an online sales tax is not new in the UK. In August 2018, Chancellor Philip Hammond suggested the idea in a Sky interview, then deeming it an “Amazon tax” and stating that “more and more of us are buying online. Indeed, Britain has the biggest percentage of online shopping of any major developed economy.”

“We need to support the high street through that process of change,” Hammond urged at the time.

Hammond also acknowledged that a tax-based solution would not be permanent and the nature of the high street would have to change to include “less retail” and more “leisure, bars, community facilities.”

Later in the year, an online sales tax was deemed incompatible with EU rules, which state that it is illegal to give financial advantage to some companies and not others in a way which could distort fair competition. However, Chancellor Hammond did announce a reworked version of the tax, which targets search engines, social media platforms and online marketplaces, in language compliant with EU regulation.

Other EU countries are also pushing ahead with their own versions of accountability for digital businesses. On January 1, France introduced a digital levy on direct sales, as well as “advertising revenues, websites and the resale of private data.” Meanwhile, in 2018, Germany brought in a roster of tax-based measures to tackle online VAT fraud and make online businesses operating in Germany liable to pay VAT on goods sold in the country. What the UK, France and Germany have in common is their highly developed retail markets, which the countries are seeking to preserve. However, the same will has been lacking across the EU, meaning the development of similar, union-wide legislation will likely stall until 2020 – when the UK will have left the Union.

Tax is just one piece of the puzzle

This week’s parliamentary report outlines its vision for “activity-based community gathering places where retail is a smaller part of a wider range of uses and activities and where green space, leisure, arts and culture and health and social care services combine with housing to create a space based on social and community interactions.”

In fact, retailers can broaden their store concepts to include such spaces. Partnering with community leaders on activities and events to draw in visitors could serve as a boon for businesses, boosting sales and profits and improving the retailers’ image with the socially-conscious shoppers of today.

This broader vision is one that both retailers and communities will need to embrace in order to survive, as business moves online. The simple truth is that, even with an online tax making digital prices more equal to physical ones, the former still offers more convenience. One way to tackle this could be through a more holistic, experiential approach to retail.

A similar concept already exists – with remarkable success – in China. The country’s largest native digital retailer, Alibaba, is already giving Amazon a run for its money globally. The key to Alibaba’s success is its holistic approach to retail. Alibaba’s brands run across digital and physical retail, as well as physical services. They include online marketplaces, digitalized (but highly experience-focused) supermarkets, a franchising endeavor to digitalize local convenience stores (while retaining their original ownership) and even a bike rental business. Alibaba even invests in local infrastructure to improve its ability to deliver goods across rural China.

Of course, such a benevolent effort from a UK or other European retailer is unlikely, partly because achieving the regulatory approval is complicated in such a disparate legal landscape. Achieving such a seamless integration of retail, community and digital services would only be possible through a consistent, long-lasting collaboration between businesses, communities and government.

[“source=forbes”]