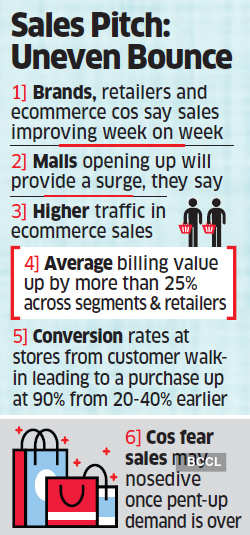

Kolkata | New Delhi: There’s a V-shaped demand recovery in major consumer goods segments but that V may not last long.

Across phones, consumer durables, apparels, shoes — in both online and offline stores — demand is close or equal to pre-lockdown levels. In certain products, the buying-spree is remarkable. iPhone SE clocked the highest sales for an iPhone model on Flipkart. Chinese brand Realme launched TV on Tuesday and sold 15,000 units online in 10 minutes.

But industry executives are not sure the buying surge will last long as pent-up demand may get exhausted.

A major source of demand is coming from non-metro cities and towns, retailers say. While brick-and-mortar stores are seeing around 70-85% of their January-February average sales, in ecommerce, orders are over 90% of pre-Covid levels for Amazon and Flipkart. Several brands said orders from their own web stores have surged.

Senior executives in Xiaomi, Reliance Digital, Puma, Benetton, Realme and Spencer’s Retail said pan-India sales may soon return to usual once malls reopen.

As per Pine Labs’ point-of-sale data, sales of electronics and home appliances in smaller cities like Ludhiana, Chandigarh, Mohali, Lucknow and Dehradun have overtaken pre-Covid days though number of transactions are lower. All India (excluding Delhi and Mumbai) gross transaction value in May is back to pre-lockdown average.

In smartphones, sales are at 73% of pre-Covid levels.

Reliance Digital has seen pre-Covid sales levels come back, while Southern phone retailers like Sangeetha Mobile and Big C Mobiles are seeing brisk growth.

Order Value per Bill is Also up

Puma India MD Abhishek Ganguly said sales across online platforms have grown 15% from that in pre-Covid period, though 18% of the pin codes are still not operational due to containment zone restrictions. “A lot of new consumers are now buying online,” he said.

Order value per bill is also up, retail chains and brands said. For Big Bazaar it is up by 27%. Pine Labs data shows average order value is up 80% for smartphones nationally. Croma also confirmed an increase in average purchase value.

Sundeep Chugh, CEO of Benetton India, said online sales are at 90% of pre-Covid levels and some offline stores have matched pre-Covid numbers. Also, average transaction value has gone up. Biba has seen usual sales figures back in ecommerce. Future Group’s value fashion format Brand Factory’s offline outlets in Kollam, Mysore, Gangtok and Thiruvananthapuram are back to pre-Covid sales levels.

Food and grocery hypermarkets like Future Group’s Big Bazaar, Spencer’s Retail and Nature’s Basket said business has gone up week-on-week, with non-mall stores and those in smaller cities driving the recovery.

Spencer’s Retail and Nature’s Basket MD Devendra Chawla said consumers have added more categories in their shopping basket, and grocery sales are at 90-95% of pre-Covid levels, and including fashion and general merchandise it is around 80-85%.

How long this will last is what industry is wondering. A senior executive with a leading marketplace said: “We fear this demand surge may not continue for long”.

India’s FY21 growth may be negative, most estimates have said, and the full impact of job cuts and pay loss will work itself out over two or three quarters.

source: economictimes