China’s push to encourage lending to smaller companies has created a business opportunity for large financial technology companies.

As Beijing struggles to balance a crackdown on high debt levels with maintaining growth, President Xi Jinping and Premier Li Keqiang have both publicly announced support for privately-run companies. The central bank has also freed up cash for lending in recent months, and eased rules to help small businesses obtain funds more easily.

Still, the business environment — particularly in financing — still favors state-owned companies, despite the fact that the private sector contributes to the majority of job creation and economic growth in the country.

But there’s money to be made for those willing to lend to smaller businesses, particularly if some of the risks can be mitigated. According to Tencent-backed online lender WeBank, roughly 80 percent of the nearly 90 million small and micro-sized enterprises in China don’t have a credit with a bank.

That’s where fintech can play a greater role.

Thanks to their close ties to Chinese technology giants, Alibaba-backed online lender MYbank and Tencent-backed WeBank can use hordes of payment information or social network data to ascertain the ability of a business to pay back its loans. That’s the kind of basic credit information many companies in the private sector have been unable to provide, and partly why traditional banks prefer to lend to large, state-owned enterprises instead.

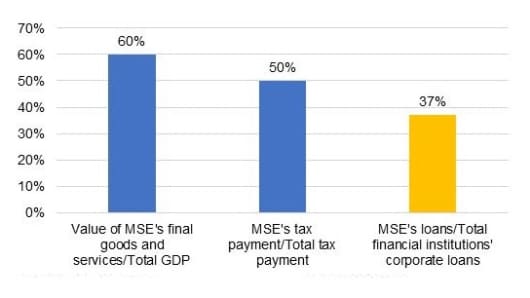

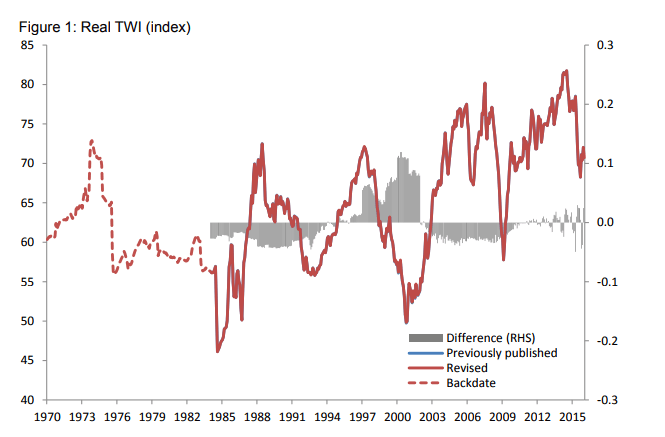

Micro and small-sized enterprises do not get equal financial support relative to their contribution to China’s economic growth

Source: PBOC, CBIRC, Kapronasia

In the past, banks have been unwilling to lend to small businesses due to their lack of collateral, limited profitability and greater business risks, said Felix Yang, analyst at financial services consulting and research firm Kapronasia. The process of taking out a loan from banks is also slow and complicated, giving companies more incentives to turn to other lenders, even if the interest rate is higher, Yang said.

Smaller loans, quicker application

In contrast, taking out a loan through an online service in China can take just a few minutes.

“Platforms like MYbank, Su’ning Finance, and other internet finance providers may push one step closer to close the finance gap for MSEs (micro and small-sized enterprises) in China,” Yang said in an email. He noted that traditional banks rarely issue loans of less than 1 million yuan ($148,385), while the average size of a loan on a fintech platform is often far smaller.

The average size of a loan to small and medium-sized enterprises and individual businesses on MYbank is about 9,900 yuan ($1,469), according to minority stakeholder Ant Financial. As of the end of September 2018, the latest figures available, nearly 9.78 million of such businesses had received a cumulative total of more than 1.19 trillion yuan in loans through the online platform. The non-performing loan ratio was about 1 percent, according to Ant.

Alibaba-affiliated Ant Financial, which is reportedly valued at $150 billion, also operates one of the prevailing Chinese mobile pay systems, Alipay. With authorization from the user, information on customer transactions can also be used to determine what kind of loan — either through MYbank or another Ant Financial service — a business can apply for.

Tencent-backed WeBank has also been expanding its business with small and micro-sized enterprises.

In late 2017, WeBank launched an online-based lending product for small businesses in Shenzhen, of which more than 200,000 have been reached in less than a year, Li Nanqing, WeBank president and party secretary, wrote in the People’s Daily on Dec. 14, 2018. Nearly half of those companies are in manufacturing and high-tech, he said.

“In order to provide enterprises with better loan support, WeBank thoroughly implemented the Party Central Committee’s arrangements to support the development of small and micro-sized enterprises, actively using data technology to optimize costs,” Li said in the article.

The company currently offers loans to small and micro-sized enterprises in the provinces of Guangdong, Jiangsu and Henan, according to its website.

Partnerships with existing financial institutions

As is often the case with the intersection of finance and technology, fintech has not always had a smooth relationship with the Chinese government. Beijing has tended to let technologies develop, before trying to push back with more stringent regulation. For large fintech companies such as Ant, their latest strategy has focused on partnering with existing financial institutions.

“We are seeing a significant increase in demand for our technology products and services from banks, asset management firms, insurance companies and securities brokers that are looking for ways to better service their customers at a lower cost,” an Ant Financial spokesperson said in a statement. “This includes banks that are trying to reduce the lending costs for (small and medium-sized enterprises) to help them survive and thrive.”

[“source-“forbes”]