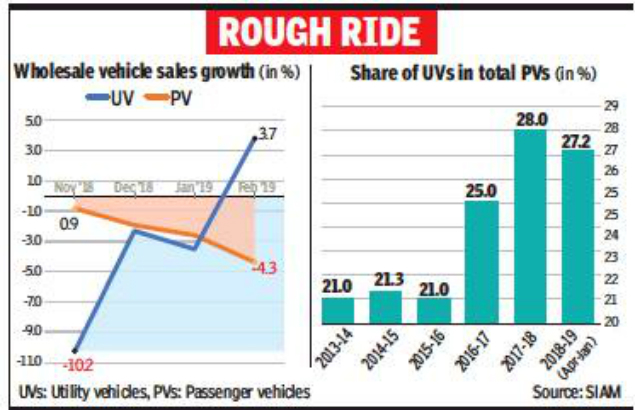

In 2013-14, only 1-in-5 passenger vehicles sold in India was a utility vehicle. By 2016-17, their share had increased to 1-in-4. And last fiscal, it peaked at 28%. However, figures for the April-January period of this financial year show their share is down to 27.2% (see graphic). While car sales have also slowed since November, the dip in SUV sales is more marked. In January, SUV sales were down 3.5% compared to 2.6% for cars. In December, 2.3% fewer SUVs sold compared to 2% fewer cars. And in November, when car sales fell 1%, SUV sales were down 10.2%.

In February, however, total UV (including SUV and MPV) wholesales rebounded on the back of aggressive billing by companies before the year-end and good performance by the MPV segment. SIAM data shows total UV sales were up 3.7% in February, while cars were down 4.3%. For April-February, cars were up nearly 3%, while total UVs (including MPVs) were up 2%.

Suzuki Vitara Brezza, the best-selling compact SUV, saw sales crash from 14,378 units in November to 9,667 in December, although it rebounded to 13,172 units in January. Second placed Hyundai Creta sold 9,677 units in November; 7,631 in December and 10,314 in January.

Industry experts say both the compact and the mid-sized SUV segments are affected. These have the maximum models and account for the bulk of sales. In the compact SUV segment, sales were down by 5% — to 1,44,203 from 1,51,141 units — in the November-February period. In the mid-sized segment (Hyundai Tucson, Jeep Compass, etc), sales fell 19% to 10,105 units from 12,618 in the period. Sales of medium premium SUVs (Toyota Fortuner, Ford Endeavour, etc) were down 9%, to 10,580 units from 11,656 units. However, premium SUVs, such as Land Cruiser and Prado, sold 37 units as against 30 earlier.

Sales have fallen due to the overall subdued consumer sentiment, said Mahindra & Mahindra president (automotive sector) Rajan Wadhera. “In December, a call was taken to focus on retail to bring dealer stocks to normal, and this has resulted in low performance. The availability of finance is an issue.” He said buyers are avoiding highpriced SUVs.

Other experts said people may be delaying buying to wait for BS-6-compliant vehicles. Also, SUVs, which mostly have diesel engines, may be looking less attractive because fuel prices are again rising and diesel is inching closer to petrol.