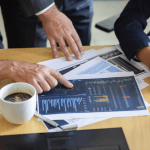

Getting additional funding for your business can really help a lot, especially if you’re just setting up. The requirements may be different from personal loans, however, so it’s important that you take a good look at it before signing on the dotted line.

Here are some helpful tips that can get you approved faster for private commercial loans, so you can continue with your business plans uninterrupted.

Decide Type of Loan

There are different types of commercial loans to choose from, so you need to make sure you get the one that suits your needs best. For example, there’s a loan that specifically helps you set up your business. There’s another one that helps you manage and run it on a day-to-day basis. Then, there’s also a loan that helps you grow and expand your business, either by setting up another branch, buying more equipment, or even acquiring another.

Complete Application

You want to do this at the soonest possible time to get the process going. Make sure you have all your documents ready, and filed on time. Maintain an open line of communication with your loan agent so you can be updated as to the status of your application, or if there’s anything else you need to submit.

Maintain Good Credit

As much as possible, try to keep good credit. This makes you more appealing to lenders, and can increase your potential not only for being immediately approved for the loan, but also for getting a good rate.

Expect the lenders to carry out a credit check on your account to verify your eligibility for their loan offer. If you have less than ideal credit, however, you can look for other alternative lending sources that have much more lenient requirements for lenders with bad credit.